Financial Services

Invest In Your Team's Success

Just like a smart financial strategy, investing in your team delivers lasting returns. Strengthen relationships, boost morale, and create a workforce that’s committed to success.

3 Major Problems in Financial Services

Driving Down TurnoverEmployee turnover in finance and banking is a growing concern, with a rate of 18.6%. Making it among the highest across all sectors. Low engagement, rapid technological shifts, and poor work-life balance all contribute to this trend. Given that 50–70 hour work weeks are often the norm, it’s no surprise that work-life balance has become a driving factor in professionals’ decisions to leave the industry. |

|

|

|

|

|

The Impact of StressThe financial industry’s high-stress environment is driven by tight deadlines, demanding clients, and market volatility which contributes heavily to employee burnout. This stress leads to disengagement, low productivity, and high turnover. Addressing burnout with better workplace practices and support is key to improving retention and employee well-being. |

Culture and LeadershipA positive culture and strong leadership are key to retaining employees in the high-pressure financial industry. Without clear values and guidance, employees become disengaged and less productive. Weak leadership worsens this by leaving teams without direction, accountability, or motivation. This not only lowers morale but also harms customer trust and overall performance, making long-term success difficult. |

|

|

The Reality of Burnout in Manufacturing

Hard work drives this industry: long shifts, quick problem-solving, and relentless follow-through. But there is a fine line between dedication and burnout. When once-reliable employees disengage, call out more often, or quietly job hunt, it takes a toll on productivity, retention, and morale. Addressing burnout isn’t just good for employees—it is essential for long-term success.

The Reality of Burnout in ManufacturingHard work drives this industry: long shifts, quick problem-solving, and relentless follow-through. But there is a fine line between dedication and burnout. When once-reliable employees disengage, call out more often, or quietly job hunt, it takes a toll on productivity, retention, and morale. Addressing burnout isn’t just good for employees—it is essential for long-term success. |

|

|

|

|

|

Balancing Expansion and Retention: The Future of Hiring in ManufacturingTurnover and retirement rates have been steadily increasing, with 66% of manufacturers reporting that filling open positions now takes longer. The challenge of recruiting skilled workers has put additional pressure on companies, forcing them to refine hiring strategies and invest in employee retention efforts. |

Consequences of a poor manufacturing work cultureA lack of creativity and innovation leaves employees disengaged, hindering both personal growth and company progress. In manufacturing, poor culture often drives workers to seek more fulfilling roles elsewhere. This revolving door effect reduces productivity and increases training costs. While there’s momentum to improve culture, real change requires a fundamental shift in mindset—one that takes time, commitment, and a break from outdated norms. |

|

|

Source: GetHppy , Benefit News

Manufacturing Your Team for Success

Tailored Recognition Programs for Peak Performance

Seamless Integration of Rewards and Incentives

Data-Driven Insights to Boost Employee Engagement

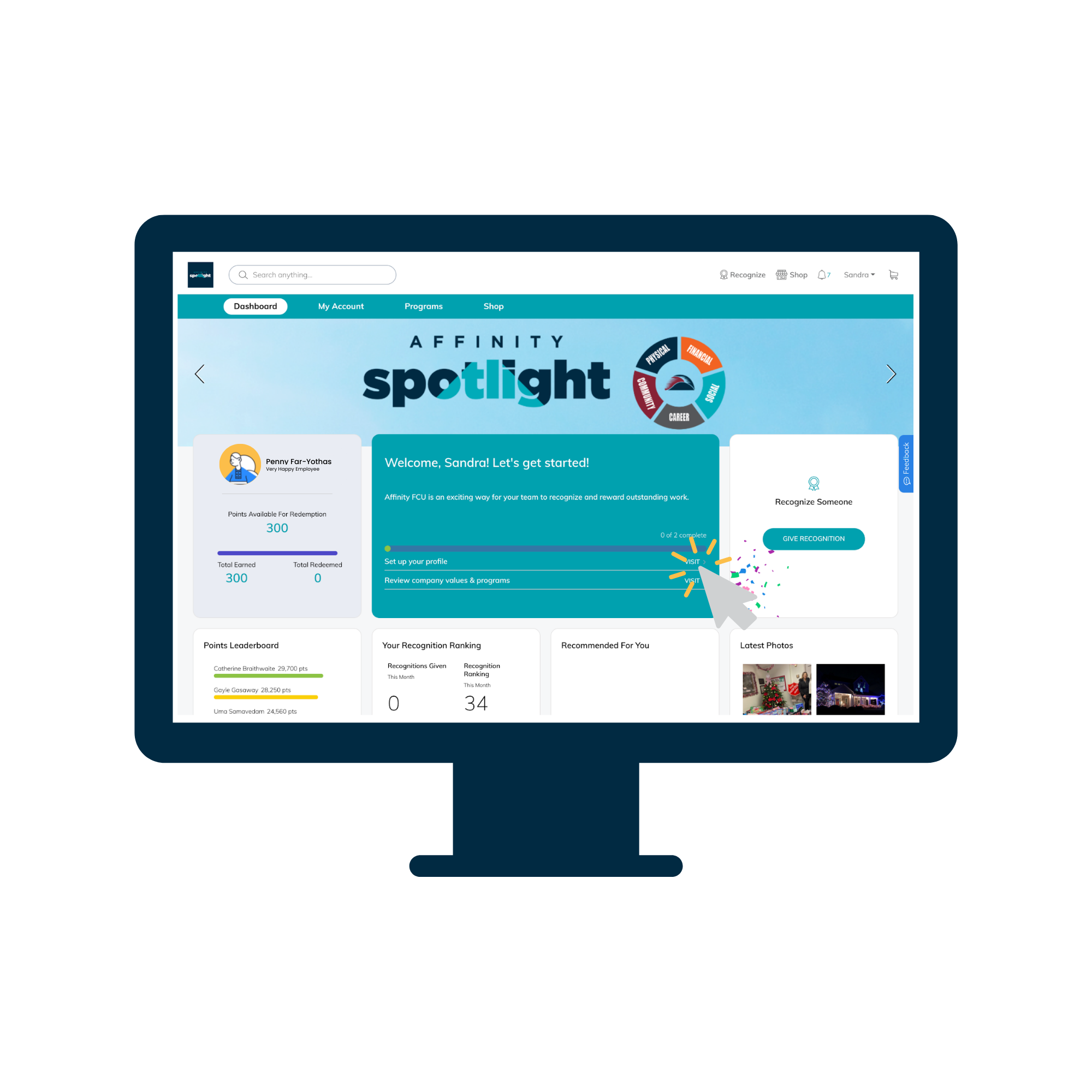

Empowering Employees: Affinity Federal Credit Union’s Amazing 70% Program Uptake Story

"At Affinity, we are proud to partner with Rewardian. Their product helps us reward employees for behaviors that embrace our core values of: Passion for Service, Trustworthiness, and Accountability. Through the use of peer-to-peer recognition, the programs we've launched with Rewardian help us reinforce what we want to see more of from our employees, and has become an integral part of our culture."

Julia Hand, Assistant VP, Affinity FCU

Financial services employees who feel recognized are more productive, more client-focused, and more likely to stay, which drives both profitability and stronger customer relationships.

Empower Your Team with Recognition

Discover how Rewardian helps financial services organizations engage employees, reinforce core values, and drive productivity. Start creating a culture of recognition today.